Cypriot banks are actively selling off foreclosed properties, with steady demand for such real estate for several years. Many foreign investors are interested in bank-owned properties in Cyprus, and the popularity of these types of properties is easy to explain—at a potentially lower cost, you can acquire profitable real estate in good condition.

Contents

What is Foreclosed Property in Cyprus?

Foreclosed property refers to real estate that is either under a mortgage with the lending bank or on the bank’s balance sheet after being seized from a debtor. For example, if a construction company cannot meet its debt obligations to the bank, or if there is a market downturn leading to the developer’s bankruptcy, the property is transferred to the bank, which then lists it for sale. This practice allows the debtor to sell the property more quickly, although often at a price lower than the market value.

Bank-owned properties mainly consist of secondary housing, but there are also many offers for newly built properties. Commercial spaces are also available for purchase. Buying bank-owned property in Cyprus offers an opportunity to save money, similar to a sale in the Cypriot real estate market, where desirable apartments are sold at reduced prices. You can find great deals in comfortable residential complexes with sea views or in central areas. If a quick sale is necessary, the price may be reduced even further. Cypriot banks also hold auctions to sell properties on their balance sheets.

Buying Bank-Owned Properties in Cyprus

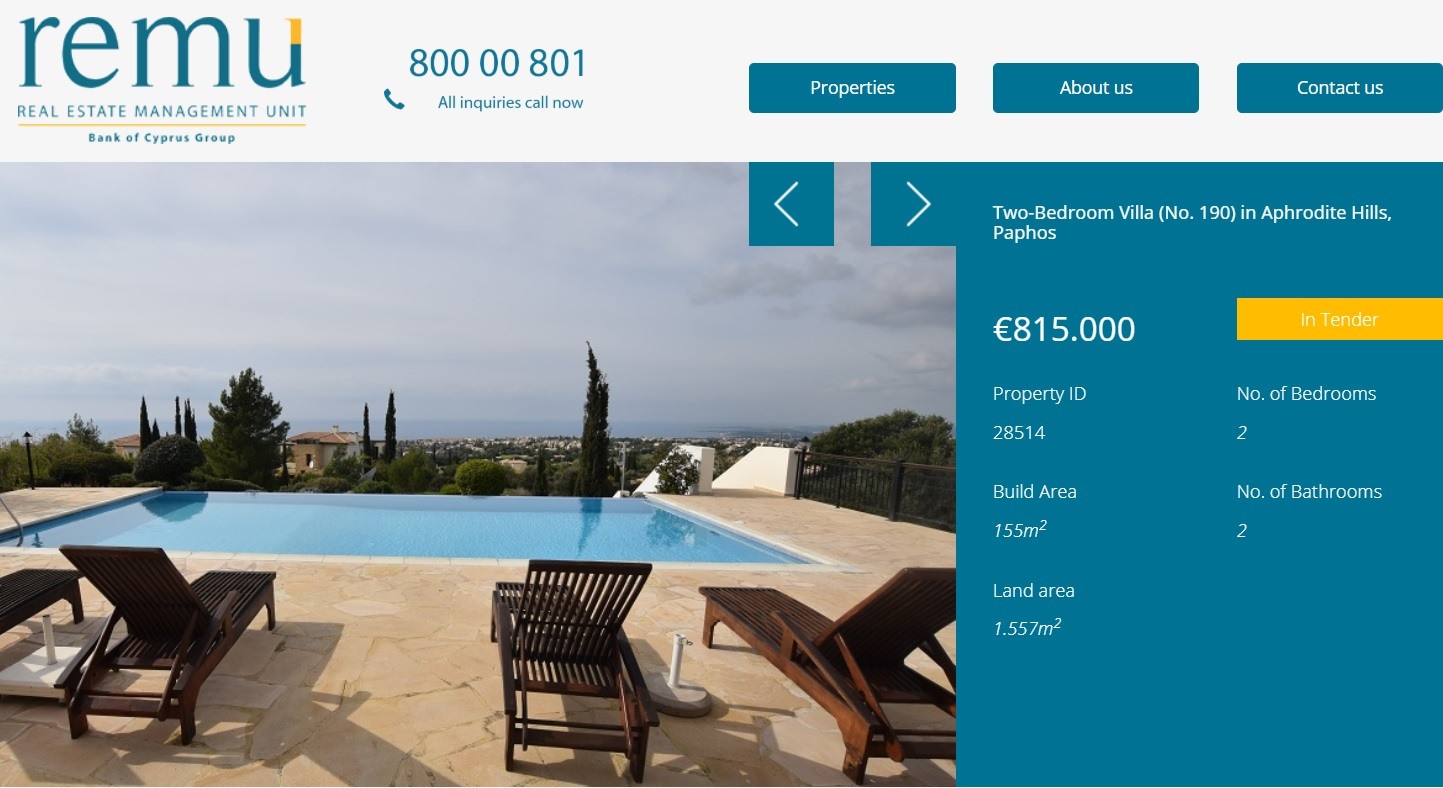

You can also purchase a bank-owned apartment with a mortgage. Foreign investors can benefit from favorable loan conditions and manageable interest rates (around 4-5%). Given the rising property prices in Cyprus, once the mortgage is paid off, you may find that you did not overpay significantly. Almost all banks in Cyprus offer foreclosed properties for sale, with the largest being Bank of Cyprus, whose foreclosed properties are managed by REMU. Each bank has different lending conditions, but buying property this way will allow you to save money. You can find foreclosed properties from Cyprus’s second-largest bank, Hellenic Bank, on the APS Holding website.

Who Should Consider Buying Bank-Owned Properties?

Foreclosed properties are a good investment for those looking to rent them out. Additionally, experienced investors actively invest in these types of properties for resale. Often, properties listed on the bank-owned market are secondary and may require renovation. Many old apartments and houses need cosmetic repairs. However, even accounting for the cost of these repairs, reselling foreclosed properties can yield significant profits.

How to Buy Bank-Owned Property in Cyprus in 2024

Buying property in Cyprus can be an attractive option for foreign investors due to favorable conditions, climate, and the opportunity to obtain permanent residency. In 2024, the process of acquiring bank-owned property in Cyprus includes several key steps:

-

Preparation and Property Search

First, you need to determine your needs and budget. Popular areas for property purchases include Limassol, Larnaca, Paphos, and Nicosia. For example, the cost of apartments in Larnaca starts at €1,400 per square meter, while in Paphos, prices range from €1,100 to €1,600 per square meter. -

Opening a Bank Account

To carry out all financial transactions, you need to open an account with a local bank. For this, you’ll need a foreign passport, the passport of your country of residence, a recommendation letter from your current bank, proof of the source of funds or a tax return for the last two years, and account activity information. -

Documentation Review and Reservation

After selecting a property, you need to review the documentation. A lawyer or agent will verify the legality of ownership and the absence of legal encumbrances. A deposit (usually 1-2% of the property value) is then made, and a preliminary purchase agreement is signed. -

Signing the Purchase Agreement

The purchase agreement (COS) is signed in the presence of the buyer and seller or their authorized representatives. The contract is drawn up in English and includes all the terms of the transaction. Citizens of non-EU countries require approval from the Council of Ministers, which is usually granted within a month. -

Payment and Registration

After signing the contract, full payment is made. Payments can be made through a bank account. The transaction must then be registered with the Land Department to officially transfer ownership of the property. -

Obtaining a Mortgage

Foreign nationals can also consider obtaining a mortgage to purchase the property. For this, you need to provide documents proving your financial status and ability to pay. The average mortgage rate in Cyprus is about 3.34%.

The process of buying property in Cyprus in 2024 is relatively straightforward but requires careful documentation and preparation. Engaging a qualified lawyer or agent can significantly ease this process and help avoid potential risks.