12.01.2023

CEO of Cypriot fintech company Ask WiRE Pavlos Loizu , in an analytical report on the domestic real estate market in the coming year, explained that residential property prices are likely to remain stable compared to the previous year, supported by increased demand and a strong economy.

Loizou summarized some of the global developments affecting prices, including the European and Cypriot economies, which at the end of 2021 experienced a gradual recovery from the Covid-19 pandemic and the adverse effects of the measures taken, such as lockdowns. In addition, he noted that the stock market at that time reached record highs, and inflation was slowly rising.

A year later, Luazou noted , supply chain disruptions became less visible, citing a global container shipping index that fell 74%, from $9,304 to $2,404, to the stock market, where the S&P 500 fell 19.5%, from 4,750 to 3,800, as well as inflation, which appears to have peaked at around 8-9 percent.

“The war in Ukraine and its associated geopolitical changes, the EU’s rapid withdrawal from Russia as a major energy supplier, and rising interest rates have led (and continue to lead) to a significant reassessment of risk across asset classes. Especially those that are highly leveraged, such as real estate,” Loizu said . “This reassessment will continue into 2023, especially as other investment opportunities become more attractive,” he added.

Loizou ‘s analysis first established the structure of the assessment before using it to analyze the situation in Cyprus. He noted that “higher disposable income, population growth, looser credit requirements and lower interest rates are all driving up home values.”

Moreover, he stated that, as with residential real estate, the price of commercial real estate tends to shift upwards with GDP growth and fall when interest rates and returns on other investments are higher. “International investors influence the dynamics of property prices in both residential and commercial real estate,” he said.

Ask CEO Wire explained that disposable income is likely to fall due to soaring prices, high inflation and rising interest rates. Moreover, banks have tightened lending criteria for all types of real estate, and interest rates on mortgages, development and investment have risen and continue to rise.

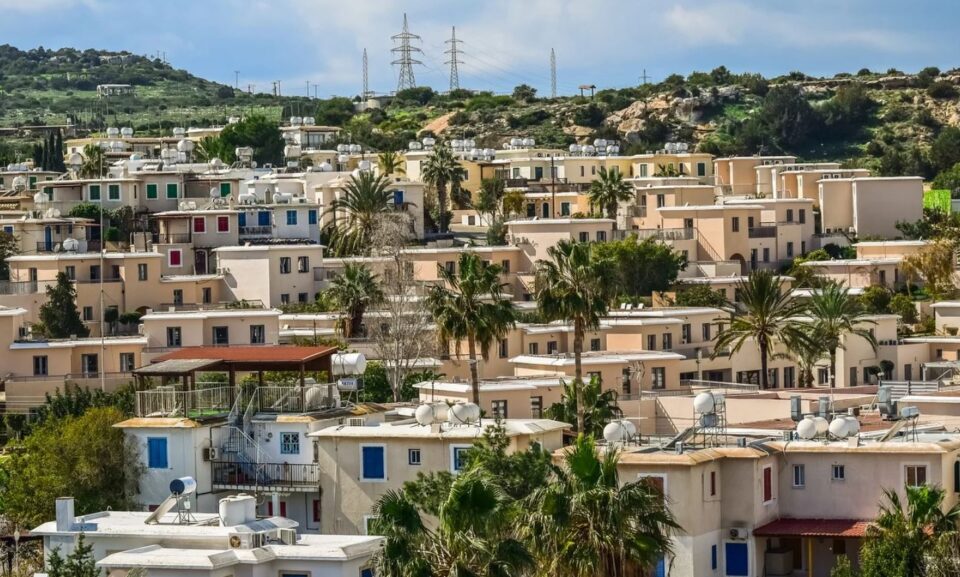

“On the other hand, the population has increased significantly due to the arrival from Ukraine, Russia, Belarus and other countries, which has led to a jump in rents and housing prices in certain areas,” Loizou said , noting that “the influx of foreign investors, especially from Lebanon and Israel is also causing price increases for certain types of property”, which primarily affects small residential buildings and tourist facilities in Larnaca .

In terms of commercial real estate, said Loizou , Cyprus’ GDP continues to grow, but with higher interest rates and higher returns on alternative investments, property investment for income or capital gains has become less attractive.

“For example, the yield on 10-year bonds of the Cypriot government is currently 4.2%, while Greek and Cypriot banks are issuing preferred bonds and second level bonds with coupons of 7.0-10.0%,” he said. “The above indicates that the main drivers of growth in the local real estate market are likely to be population growth, inward investment from abroad and volatile supply as it takes 2-4 years to build up a significant level of real estate inventory),” he added. he.

As a result of the above , Luazou explained that it would be reasonable to assume that the market would split into two separate tiers, with some properties targeted at domestic buyers and others targeted at international investors. One of the variables here, according to Loizou , is whether international investors and buyers will stay long-term to maintain the current price range.

“The likely answer is yes, as the local business environment and political stability take into account what is happening in the region, and the way of doing business “work from anywhere” plays into the hands of Cyprus,” Loizu said .

Meanwhile, Luazou emphasized that the aforementioned “volatile supply” is causing prices to rise, before noting that this “is likely to change in the medium term as new projects are announced, especially in West Limassol and parts of Larnaca .”

He went on to explain that new housing construction has not fully recovered from the 2008 housing crisis and the 2013 banking crisis, and residential real estate supply remains near historic lows.

“This has made houses out of reach for many, especially first time buyers,” Loizu said . Moreover, he noted that the demand side has been heavily affected by population growth over the past decade, which happened for a number of reasons.

“We do not expect the Cyprus housing market to undergo a significant correction as the economy remains strong and demand for housing is still relatively strong. In fact, low supply and high demand mean that house prices are unlikely to fall significantly in the near future,” Loizu said .

“However, the likelihood of slower home price growth and lower sales next year could make it easier for potential buyers to access affordable housing. We are less positive about commercial real estate, where the range of alternative investment opportunities has increased significantly over the past year,” he added.

“This, combined with rising interest rates, could lead to repricing in the short to medium term, especially for small apartments and legacy properties,” Loizou concluded .