31.03.2022

The decision to invest in foreign countries contains a number of clarifications. The investor studies and analyzes data such as the legal framework, ETFs, and stock market opportunities. However, there are times when investors neglect an important first step in the international investment process: the decision to invest abroad begins with determining the state of the investment climate in the country in question. He must study the economic, political and business environment in order to protect himself from any investment losses.

So what makes a country attractive for investment funds? A country that can repay its debts and has stable finances provides a safer investment than a country with a weak or unhealthy economy. An important parameter is its political situation. This is because political decisions made within a jurisdiction may result in unanticipated damage to investors or profits, respectively. The investor must also take public debt seriously. Through its monetary policy, a foreign central bank can influence investment like dominoes, with positive and sometimes negative influences.

Investment starts from Cyprus

As one of the fastest growing investment fund management centers in Europe, Cyprus is dynamically entering the investment fund map. Its development is based on its economic, social and political stability, as well as an attractive – stable regulatory environment.This regulatory environment, combined with its geographic location, unique professional know-how, and the many benefits it brings, is a magnet for investment funds and regulators, as well as specialized service providers from around the world. In recent years, dozens of managers from different geographical regions have chosen Cyprus as their base.

Benefits and investment opportunities

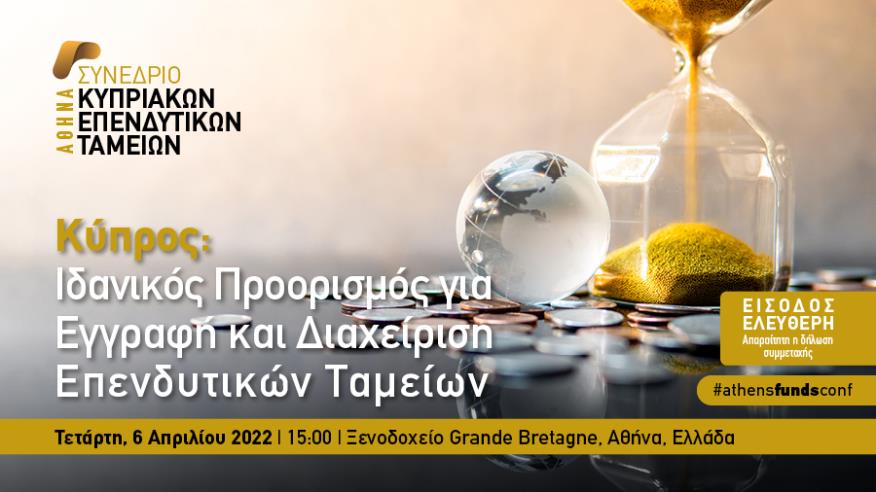

Cyprus is an ideal choice for the establishment and management of investment funds, alternative investment institutions, collective value investment institutions as well as alternative investment institutions from Greece. The conference “Cyprus: An Ideal Destination for Registration and Management of Investment Funds”, which will take place on April 6, 2022 in Athens, is designed to introduce professionals and investors to the investment fund ecosystem of Cyprus, as well as the advantages of Cyprus. At the conference, participants will have the opportunity to ask questions, as well as discuss and network with Cypriot professionals in this field.

The topic-rich conference is expected to attract a large number of people who want to receive valuable information about the country’s investment and economic climate. The first topic is still the Cypriot economy, and then the participants will learn what it means to “do business” in Cyprus. The conference will also present the Cypriot investment fund ecosystem and then analyze the advantages of Cyprus as a destination for registering and managing investment funds.

The conference will be held in Greek.

The event is addressed to professionals:

Investment companies

To providers of investment services (investment services)

Investment intermediary companies

Alternative Investment Institutions (AIFs) and AIF Managers

Collective Investment Entities in Securities (UCITS) and UCITS Managers

Investment fund managers

Banks and other financial institutions

Investment banks and private banks

Law firms and legal consultants

Accounting, auditing and tax companies

Wealth and asset management companies

Corporate service companies

Business consulting services

Participation is free, subject to registration.

Organizer: IMC

Supported by: Cyprus Investment Fund Organization (CIFA), Invest Cyprus

Communication sponsors: GOLD magazine, IN Business magazine