21.07.2022

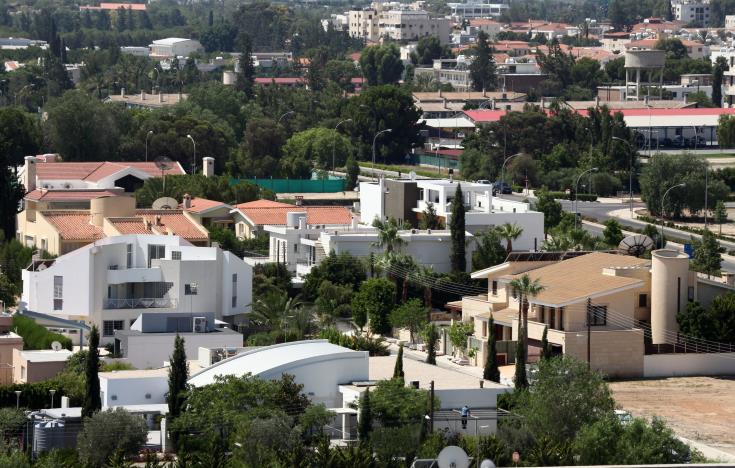

At present, the real estate sector is not a destabilizing factor for the banking system, nor are there fears of a real estate bubble or leftovers from the defunct citizenship by investment scheme, the Central Bank of Cyprus says.

In its latest report on the stability of the financial sector, the Central Bank noted that although a possible decline in real estate prices is always a concern for the banking sector, in today’s environment, a fall in prices is unlikely.

“It is unlikely that property prices will decrease, mainly due to an increase in the amount of building materials, but also due to an increase in demand, mainly from Cypriots who prefer apartments due to the good yield offered by the rent,” reads the CBC message.

It says the property market has proven resilient during the pandemic, helped by fiscal measures taken by the government, boosting local demand for housing.

The boost cycle was launched in April 2020 thanks to a supportive fiscal framework, including a housing and corporate interest rate subsidy scheme.

The government extended the interest rate subsidy scheme for housing and corporate loans until the end of 2021 and raised the ceiling for eligible loans.

“In 2021, the Central Bank House Price Index (CPI) began to show signs of recovery after a slight stability seen in 2020.

“In fact, residential property prices in Cyprus seem to remain below their potential value.

“Conjuncture in the real estate sector and especially the performance of commercial real estate can directly and/or indirectly affect the stability of the financial system.”

The bank clarified that property values in Cyprus are still valued lower than potential suggests and significant adjustments should not be expected.

He also sees new home-buying lending as sustainable.

“The fact that the criteria for household home loans, according to the latest review of Central Bank bank lending, remained unchanged in the fourth quarter of 2021 after the continued tightening of criteria from the second quarter of 2020 to the third quarter of 2021, largely guarantees that new mortgage lending will remain stable.”